About 'portfolio accounting system'|...commitment to fact and reason within both American journalism and the broader political system. Though lying is not foreign to U.S. politics and media, ...

...As Student Credit Card Debt Rises, Banks Quietly Reward Schools Colleges Make Millions Selling Access and Addresses to Bank of America By Ben Protess and Jeannette Neumann Huffington Post Investigative Fund Some of the nation's largest and most elite universities stand to gain millions of dollars from selling the names and addresses of students and alumni to credit card companies while granting the companies special access to school events, the Huffington Post Investigative Fund has found. The schools and their alumni associations are entitled to receive payments that multiply as students use their cards. Some colleges can receive bonuses when students incur debt. The little-known agreements have enriched schools and some banks at a time when young women and men already are borrowing at record levels, raising questions about whether such collegiate and corporate alliances are in the best interests of students. "The fact that schools are getting paid for students to rack up debt is a disgrace," said congressman Patrick Murphy, a Pennsylvania Democrat and former professor at the U.S. Military Academy at West Point. He said that banks' payments to schools amount to "kickbacks." KEY FINDINGS Our examination of affinity agreements involving some of the nation's largest and most prestigious colleges revealed that schools and alumni associations: Sell students' personal information. Many are contractually obligated to share students' names, phone numbers and addresses with banks. Earn royalties: Banks typically pay schools $1 for each student who keeps a credit card open for 90 days. When students carry a balance, some schools can collect up to $3 more per card. Cash in each time a student uses plastic: Many schools are entitled to receive 0.4 percent of all retail purchases made with student cards. Benefit from marketing incentives: When a university or alumni association agrees to market cards to students itself, the payoff is greater -- sometimes up to $60 for each card opened through a school's own marketing. Offer special perks: Banks sometimes gain special access to athletic events. Cornell University must provide Chase Bank with tickets and "priority" parking passes at football, basketball, hockey and lacrosse games. Landmark credit card legislation signed by President Obama one year ago curbed some marketing tactics on campuses but didn't prohibit the arrangements between colleges and banks, known as "affinity" agreements. The substance of these deals had been secret. A provision in the law, authored by Murphy, requires their disclosure. But even now, few schools post the contracts online or publicize their existence. Obtaining a copy can take two weeks or more. Thus it's unclear how many of the nation's 2,700 four-year colleges have such agreements, or how many allow credit card companies to target students in addition to graduates. Bank of America, which dominates the market, said it has affinity contracts with some 700 schools and alumni associations, where marketing practices vary. At least 100 schools are believed to have affinity agreements with other financial institutions. Seventeen contracts obtained by the Investigative Fund from schools and their alumni associations detail the special access granted to banks, such as allowing them to set up booths at football games. All of the agreements call for colleges to provide students' names, phone numbers and addresses. For granting such access and information, schools can receive royalty payments based on the number of students opening accounts and the amount they spend, the contracts show. Most of the schools are entitled to earn more whenever a student carries a balance from year to year. Some consumer advocates question whether colleges participating in affinity agreements are failing to safeguard the young people in their care. "Universities should place the welfare of their students as their highest priority and shouldn't sell them off for profit," said Ed Mierzwinski, consumer program director for the federation of state Public Interest Research Groups, or PIRG. Three schools, after being contacted by the Investigative Fund, stopped allowing banks to market to students. Seven other schools and alumni associations, including alumni organizations at Brown University and the University of Michigan, said they have abandoned the practice, even though their contracts appear to require it. The contracts call for a range of minimum payments by banks. At Brown, Bank of America agreed in 2006 to pay $2.3 million over seven years. At Michigan, the bank in 2003 agreed to pay $25.5 million over 11 years. The bank says it's not taking advantage of students; it's amassing new customers whose loyalties can span a decade or more. "Our objective in serving the student market is to create the foundation for a long-term banking relationship," Bank of America spokeswoman Betty Riess said in an email, adding that the bank offers reasonable rates and low credit limits on student cards, and that it primarily solicits graduates and sports fans. Many schools have renegotiated contracts with the bank to limit marketing to students, she said. Schools still engaging in the practice defend selling access to students and their contact information. Colleges say the money helps them plug holes in budget shortfalls and shrinking endowments. Some say they use the money to grant more scholarships to students. Some colleges and alumni organizations also argue that students need to learn fiscal responsibility-and how better to do that than by having a credit card? The University of Michigan alumni association, facing growing scrutiny from consumer groups, says it reached an agreement with Bank of America to stop marketing to students in early 2008. Jerry Sigler, chief financial officer of the alumni association, said he made the decision begrudgingly. "Managing credit is as much a part of education and maturation as anything else going on campus," he said. "Credit isn't bad, it's a reality." The benefits are not always so obvious for students whose families already face soaring tuition costs and hefty loan payments. College seniors graduated in 2008 with average credit card debt of more than $4,100, up from $2,900 four years earlier, according to data compiled by student lending company Sallie Mae. On their own for the first time, young credit card users can quickly fall behind on payments. Despite not having a full-time job or much in savings, Lisa Smith easily found her first credit card on campus-from bank marketers stationed outside her freshman dormitory. Once she racked up charges, new card applications poured in from other companies. By the time she graduated in 2005, she had the average number of credit cards for a college student - four - as well as $15,000 in credit card debt. Now 28, Smith is still paying $500 monthly in credit card bills, some dating back to purchases from her college days. "I know that I brought it on myself," said Smith, who attended High Point University in North Carolina, which says it now prohibits on-campus marketing. "But I really felt like I was preyed on. I didn't understand how long it was really going to take to pay them back." Students 'Hugely Important' On May 22, 2009, President Obama signed sweeping new consumer credit card protections into law. All too often, Obama noted at the time, Americans used credit cards as an anchor rather than a lifeline. Students were no exception. The Credit Card Accountability, Responsibility and Disclosure Act prohibited banks from using some of their most aggressive marketing practices on students. For instance, banks can no longer require students to apply for a card to receive promotional gifts such as pizza or sweatshirts. Nor can banks supply credit cards to anyone under age 21-most college underclassmen-unless the customer has a cosigner. The law requires only that the co-signer be over 21. The co-signer needn't be a parent or guardian. The law does not prevent credit card companies from paying schools for special access to students. Chase Card Services, a division of JPMorgan Chase & Co., has a handful of such agreements, but Bank of America dominates. It became the market leader in 2006 when it acquired credit card giant MBNA, a pioneer in affinity agreements that often involved pro sports teams and professional associations. Soon after the acquisition, Bank of America set its sights on colleges. At a March 2006 conference hosted by Goldman Sachs, Bank of America executive John Cochran described students as "an emerging market that we could really capitalize on," according to a transcript. From a bank's perspective, students represent an important demographic: Not only do many first-time cardholders hunger for credit; they arelikely to stay customers for quite some time - up to 15 years, according to a 2005 study by Ohio State University researchers. "Student credit cards are hugely important to a bank," said Kerry Policy Groth, who negotiated collegiate affinity agreements as an MBNA account executive from 1998 to 2005. "Your first credit card is usually the one you keep." Although Bank of America does not disclose how many student accounts it has or what it earns from student credit cards, Cochran, at the 2006 conference, characterized the collegiate affinity market - students, faculty, alumni and sports fans - as "an over $6 billion portfolio." The portfolio may have declined in recent months as the bank's entire credit card business has suffered from rising default rates. Bank of America spokeswoman Riess emphasized that the bank primarily targets alumni and fans as prospective customers, with students accounting for about 2 percent of all open collegiate accounts - likely representing thousands of young consumers. 'Students as Commodities' Affinity agreements vary from school to school. The University of Pennsylvania's agreement with Bank of America required the school to compile an initial list of 233,000 potential customers, including students, alumni, faculty and staff, to offer the bank. If requested, the school removes potential customers from the contact list. When Princeton University signed its affinity agreement with Bank of America in 2004, it agreed to provide the names of at least 4,000 students and 75,000 graduates. After a bank obtains the information, it can send an agreed-upon number of solicitation letters and emails. A 2008 PIRG survey of more than 1,500 undergraduate students found that about 80 percent received mailings from credit card companies. Some affinity agreements also permit banks to advertise at school sporting events. Banks often have booths at football and basketball games where students 21 or older, alumni and fans can sign up for a card. Colleges and alumni associations are entitled to rewards for providing special access and information. Bank of America typically pays schools $1 for each student who opens a credit card account and keeps it open for 90 days, according to contracts reviewed by the Investigative Fund. Some schools also can earn more as students rack up charges-and debt. The University of Oklahoma, among other schools, is entitled to receive 0.4 percent of all retail purchases made with student cards. Most of the 17 contracts obtained by the Investigative Fund entitle schools to extra compensation-up to $3 a card--when students carry a balance from year to year. "Essentially, contracts with credit card companies are using students as commodities to earn revenue for the universities from companies who don't necessarily have the students' best interest in mind," said PIRG's Mierzwinski. As part of many agreements, banks also pay for rights to use school trademarks -mascots, logos and emblems - on their advertisements. Banks often brand their cards with the familiar images. This marketing tool, known as co-branding, has its critics. Irene Leech, associate professor of consumer studies at Virginia Tech, said the practice leads some to believe that universities have negotiated favorable credit card rates for their students. "Alumni and students both think that it's the best deal out there that [the school] could get for me," an assumption that is not always correct, she said. Nor do students necessarily get the lowest rates. At Princeton, alumni cards carry an annual percentage rate of 11.9 percent, compared to 14.9 percent for student cards, according to the school's seven-year affinity agreement, signed in 2004. Rates may have changed since then. Bank of America currently charges a 14.24 annual percentage rate on its Student Visa Platinum Card, the primary product it markets to students. Students are not locked in; the rate varies depending on the market's prime rate. The bank said it doesn't increase rates on students for reasons such as falling behind on their payments. Nor does it impose an annual fee. "We take a conservative approach to lending to young adults," Bank of America's Riess said, noting that the bank limits a student's exposure to debt. The bank offers credit lines for students that "typically" start at $500 and are capped at $2,500, she said. The bank, Riess said, also seeks to educate students. "We also provide a number of tools to help young adults better manage their finances," she added, including free identity theft protection, a student financial handbook and an online educational brochure about building good credit, called "The Essentials." "Building a future customer-that was really the goal" of affinity agreements, said former MBNA executive Groth. "You're not out to gouge them; you want a positive experience." Shifting Practices This spring, Columbia University, the Iowa State University alumni association and Michigan State University all amended their affinity agreements to prohibit any marketing to students. They did so within a week of receiving phone and email inquires from the Investigative Fund. School officials said they had been working on the amendments for months. The Investigative Fund requested Columbia's contract on March 22. Columbia officials signed the school's amended agreement two days later. The timing was "mostly coincidental," according to Michael Griffin, executive director of Columbia's alumni association. He said that the school had never allowed marketing directly to students. Seven other schools contacted by the Investigative Fund said they no longer allow marketing to students, even though their affinity contracts would appear to obligate them to. School officials said they had no documentation backing up their assertions. "A lot of schools have student access in their agreements" - but don't necessarily allow it anymore, said Peter Osborne, who managed the collegiate credit card business at Bank of America until 2007. Schools sometimes informally "just request that marketing stop rather than reopening their entire contract." For instance, according to an affinity agreement between the University of Texas alumni association and Bank of America, the association is expected to provide the bank with students' names and addresses. But the alumni association says it has abandoned that practice. "We are not marketing to students at this time and we haven't for some time," said Bill McCausland, chief operating officer for Texas Exes, the ex-students' association. "Whether the contract allows us to or not, we are not doing so." He acknowledged that students could still sign up for credit cards without the school's involvement. Bank of America, he said, is "still marketing our card and they are doing a very good job of it." At Harvard, the alumni association is supposed to provide a subsidiary of Barclays PLC with "as complete a list as possible of all Harvard alumni and students," according to the association's affinity contract. But Harvard spokesman Kevin Galvin said the card was never marketed to students. "We view this card as a service to alumni," he said. Other schools acknowledged to the Investigative Fund that they release students' contact information. These schools staunchly defend their affinity agreements as important sources of revenue. And some royalties benefit students, according to school and bank officials. "The revenues from this go to vital services that otherwise might not be free and otherwise might not be offered," said Osborne, the former bank official who now advises universities as they negotiate affinity agreements. Osborne said the revenues "support alumni programs, student scholarships and preserve jobs within alumni associations." Some of the royalties from Penn's contract go to scholarships and helped pay for the development of Campus Express, an online system where students can order textbooks and manage their dining plans, according to university spokesman Ron Ozio. Princeton uses its profits "to support alumni activities," school spokeswoman Emily Aronson wrote in an email. Catherine Bishop, vice president of public affairs at the University of Oklahoma, said affinity agreements are beneficial because they limit the amount of marketing that goes on. "The contract that we have in place," she said, "is designed to keep multiple companies from soliciting on campus." This story was reported in partnership with the Stabile Center for Investigative Journalism at Columbia University. Protess is a staff reporter with the Investigative Fund. Neumann graduated from the Stabile program in May. Amanda Zamora, Lauryn Smith and Joseph Frye also contributed to this story. Help us track down credit card contracts We're assembling a team of citizen journalists to help us obtain and analyze credit card agreements at the largest schools in the country. With your help, and the help of volunteer's recruited through Campus Progress and the Huffington Post College page, we'll be compiling contract details for as many schools as possible. To help investigate, simply pick a school from our Top 50 list. Follow the Huffington Post Investigative Fund on Twitter or fan us on Facebook. Do you have information about this story? Send us a tip or submit a correction. REPUBLISH THIS STORY FOR FREE: The Huffington Post Investigative Fund licenses its content through Creative Commons. We encourage you to republish our stories in full with proper attribution. _qoptions={ qacct:"p-cfyPmCI1ILE5E" }; |

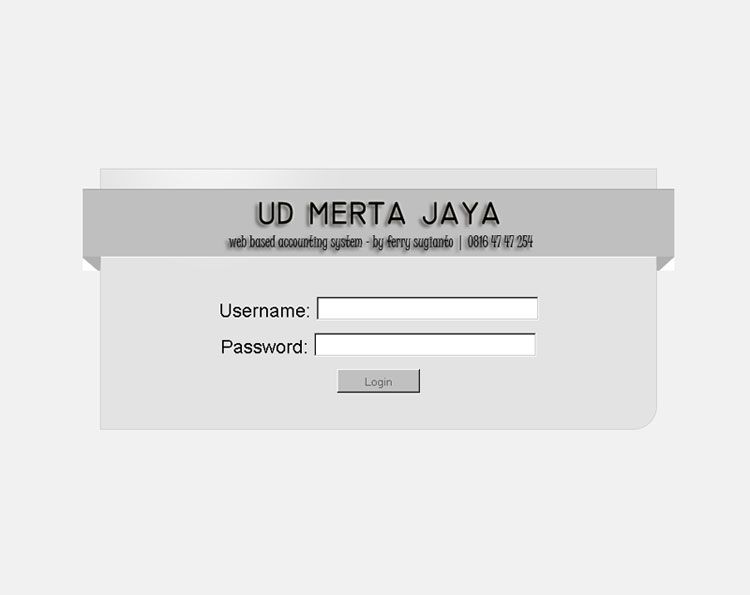

Image of portfolio accounting system

portfolio accounting system Image 1

portfolio accounting system Image 2

portfolio accounting system Image 3

portfolio accounting system Image 4

portfolio accounting system Image 5

Related blog with portfolio accounting system

- thetechcurve.blogspot.com/... available to move their work out of the system. This is crucial. When digital work...The Case for Student Managed Digital Portfolios. So what's the point of all this effort and...

- whattaboutbob.blogspot.com/.... I opened my first brokerage account when I was 18. I am very thrilled...what you have done for my net worth . My portfolio has roughly tripled after...

- investingessentials.blogspot.com/... an attempt to represent a portfolio of approximately 75% stocks and 25...money if you put it into a savings account. In the above example, if you start saving...

- eddiecampbell.blogspot.com/... to keep intact the suspension of disbelief within a time-governed narrative system, like cinema in other words. It is arguable that cinema is too much...

- teu-informatico.blogspot.com/...[srcdir]= /modules/kernel/system/startup.php?CFG_PHPGIGGLE_ROOT= /lib/includes...lite.inc.php?script_root= /modules/vWar_Account/includes/functions_common.php...

- bioseguridad.blogspot.com/...If we're going to rely on biofuels as a significant part of a diverse portfolio of renewable technology," then harvesting trees is the best way to...

- lnlcrazydave.blogspot.com/...2dB6A5%2d5DEDA75A38D2&a=18720821d568e60cd6d56dad4ddda6789e6a5b7cb451453ff6c6152cbb2c6704 On roof water collection systems Jul 31 8KB http://by114fd.bay114.hotmail.msn.com/cgi-bin/compose?msg=4E4A082C-5457-4946-B0C0...

- babaneemkaroli.blogspot.com/... seriously at that time. We all treated it as one of his favorite systems of entertaining everyone around him by making fun of someone. Tularam...

- thematrixforeal.blogspot.com/...commitment to fact and reason within both American journalism and the broader political system. Though lying is not foreign to U.S. politics and media, ...

- garveys-ghost.blogspot.com/... into their cars when they could invest that same money into a good portfolio. My point is, I believe that a large portion of the problem with black net worth...

Portfolio Accounting System - Blog Homepage Results

...already provided a full account of the panel discussion in his... from VC portfolio companies; although long... integrated System-on-Chips for the next...

...business, you need to have an accounting system in order to stay in business. So that... a franchise store or a property portfolio. Everything needs to be accounted...

The Tactical Timing System (TTS) has been painstakingly...and back-tested. In a real world account (the SMA Portfolio), TTS returned 6.2% per year versus...

Related Video with portfolio accounting system

portfolio accounting system Video 1

portfolio accounting system Video 2

portfolio accounting system Video 3

0 개의 댓글:

댓글 쓰기