About 'responsibility accounting system'|Components of the Accounting System

At first glance, accounting can appear extremely complicated and confusing. The untrained eye may struggle to grasp the entire nature of accounting and see it merely as an incomprehensible mass of numbers. However, accounting is actually much more for a company. Ultimately, accounting "is an information system that measures, processes, and communicates financial information about an identifiable economic entity" (Kanter & Pressley, n.d., Slide 1-7). Furthermore, this information is designed to make it easier for individuals with an interest in an organization to make better decisions about that particular entity (Wild, Larson & Chiapetta, 2007, p. 5). As a result, I strongly believe that the true significance of accounting cannot be fully appreciated without first examining all the different individuals who actually use this information. To help you further appreciate the importance of accounting, I have composed the following paragraphs to outline the different users of accounting information, as well as the accountant's responsibilities to each. First, we will discuss who exactly uses accounting information. Overall, these individuals can be separated into two distinct groups: (1) internal users of accounting information and (2) external users of accounting information (Sweatt, 2002; Wild, Larson & Chiapetta, 2007, p. 5). External users can further be divided into two subgroups: (1) "those with direct financial interest" in a firm and (2) "those with indirect financial interest" (Kanter & Pressley, n.d., Slide 1-27). In the end, accounting information is invaluable to all of these users. Probably the first type of users of accounting information that comes to mind is external users. This group is made up anyone outside an organization that uses accounting information to make financial decisions (Wild, Larson & Chiapetta, 2007, p. 5). As I previously mentioned, this group is made up of two subdivisions. Examples of outside individuals/entities that are directly affected by a company's finances include investors, stockholders, and creditors since they put their money at risk with investments into a business. On the other hand, other external users have a much more general interest in an organization and include customers, suppliers, the press, and regulators (Kanter & Pressley, n.d., Slide 1-27; Wild, Larson & Chiapetta, 2007, p. 5). Consequently, accounting information is crucial to external users because it can show those outside a company such things as if that company is healthy, stable, and expanding (and thus a sound investment) and if it is observing ethical business practices and accurate accounting procedures (Department of Accounting & Finance, n.d.; Wild, Larson & Chiapetta, 2007, p. 5-6). Then, we have internal users of accounting information, such as employees and the various types of managers (i.e., purchasing managers and marketing managers). Accurate accounting is extremely crucial to these individuals who make important financial and business decisions within an organization that directly affect the business itself (Wild, Larson & Chiapetta, 2007, p. 6). Fundamentally, a company "aims to sell goods and services to customers at prices that will provide an adequate return to its owners" (Kanter & Pressley, n.d., Slide 1-13). A business must maintain an adequate level of profitability and liquidity to continue operating (Kanter & Pressley, n.d., Slide 1-14). However, without accounting information, this is not possible. A firm's management needs this information to properly conduct daily activities within the business, such as finance the company, invest its resources, produce its goods and/or services, market those goods and/or services, and manage the employees (Kanter & Pressley, n.d., Slide 1-29). However, accounting information is just as critical for internal users when they make decisions that will affect the future of the company, such as the profitability of a proposed product or expansion into a new location (Department of Accounting & Finance, n.d.; Wild, Larson & Chiapetta, 2007, p. 6). In the end, despite the differences between internal and external users, the accountant has similar responsibilities to both of these groups. First, all accountants have the responsibility to always be ethical. The AICPA and state authorities recommends that every accountant should follow a code of ethics that emphasizes "responsibility to the public, integrity, objectivity, independence, and due care" (Kanter & Pressley, n.d., Slide 1-85). Furthermore, the accountant has the responsibility to both types of users to ensure that all financial information is in accordance to Generally Accepted Accounting Principles (GAP). Financial documents that are created according to GAP help ensure that accounting information is as accurate, unbiased, uniform, and understandable as possible (Department of Accounting & Finance, n.d.; Kanter & Pressley, n.d., Slides 1-79 & 1-80). Furthermore, the accountant should always strive to present accounting information that is objective and relevant to give both internal and external users the best possible picture of the company. And finally, accounting information is not worth that much to users if it is not presented in a timely manner. Thus, accountants should always strive for timeliness, as well (Department of Accounting & Finance, n.d.). References: Department of Accounting & Finance. (n.d.). Unit 1: Financial statements. Retrieved May 26, 2008, from University of Strathclyde Web site: http://accfinweb.account.strath.ac.uk/ammsc/p101.html Kanter, H. A., & Pressley, M. M. (n.d.). Multimedia slides of chapter 1: Uses of accounting information and the financial statements (In Financial accounting by Belverd E. Needles, Jr. & Marian Powers). Retrieved May 25, 2008, from Houghton Mifflin College Web site: http://www.college.hmco.com/accounting/needles/fa/instr/ppt/ch01/sld001.htm Wild, J. J., Larson, K. D., & Chiapetta, B. (2007). Fundamental accounting principles (18th edition). Boston: McGraw-Hill/Irwin. |

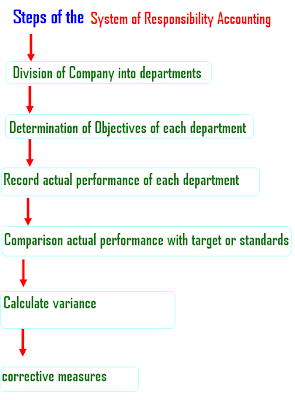

Image of responsibility accounting system

responsibility accounting system Image 1

responsibility accounting system Image 2

responsibility accounting system Image 3

responsibility accounting system Image 4

responsibility accounting system Image 5

Related blog with responsibility accounting system

- businesses-box.blogspot.com/...and areas of responsibility we need to assign include # Overall responsibility for the accounting system # Management of the computer system (if you're using one) # Accounts...

- principlesofaccounting.blogspot.com/Responsibility Accounting is a system where: Managers are held responsible for the difference between the actual performance...

- linkfarm.blogspot.com/...because investors world wide lost confidence in the dollar and the American system - a lack of regulation helped the dollar lose value.

- astrologyfree.blogspot.com/... of your inner growth. Progressions are a symbolic system of accounting for inner growth. Our natal charts are a map of potentials...

- kingdomdreamer.blogspot.com/.... But, corrupt as the system might be, it pales in... of leadership and responsibility will be called into account, and will receive as they have...

- ibloga.blogspot.com/...African nativism and Obama's having pledged allegiance to the Black Value System raises political issues of its own. The phrase, “having ...

- spectervision.blogspot.com/...the carrot. And what we need to avoid is another system that rewards parents for not taking responsibility for their own lives. I would think that ...

- msheldon.blogspot.com/... to powers, which are not granted; and on this very account, would afford colourable pretext to claim more than were granted...

- samlulu.blogspot.com/...challenge his experiences and his knowledge in accounting. I am still dependent on him to hold the responsibility that he made...why i dislike him so much...

- twocheersforthechancellor.blogspot.com/...s tax affairs. Nowadays I rarely do. Responsibility is split between different offices... error on his VAT return. When his accountant came to do Mr Sadler’s accounts...

Responsibility Accounting System - Blog Homepage Results

...Administrator‘ responsibility. (If you have ‘System Administrator’ responsibility or you are a SYSADMIN user...Functional Administrator’ responsibility to your account.) - Click on ‘Core Services...

...He oversees responsibility for National and Regional... for account as well as ...GNY Chapter of the Mail Systems Management Association (MSMA...

...comment to your blog. You are commenting using your Twitter account. (Log Out) You are commenting using your Facebook account...

Related Video with responsibility accounting system

responsibility accounting system Video 1

responsibility accounting system Video 2

responsibility accounting system Video 3

0 개의 댓글:

댓글 쓰기